Managing Underwriting Application

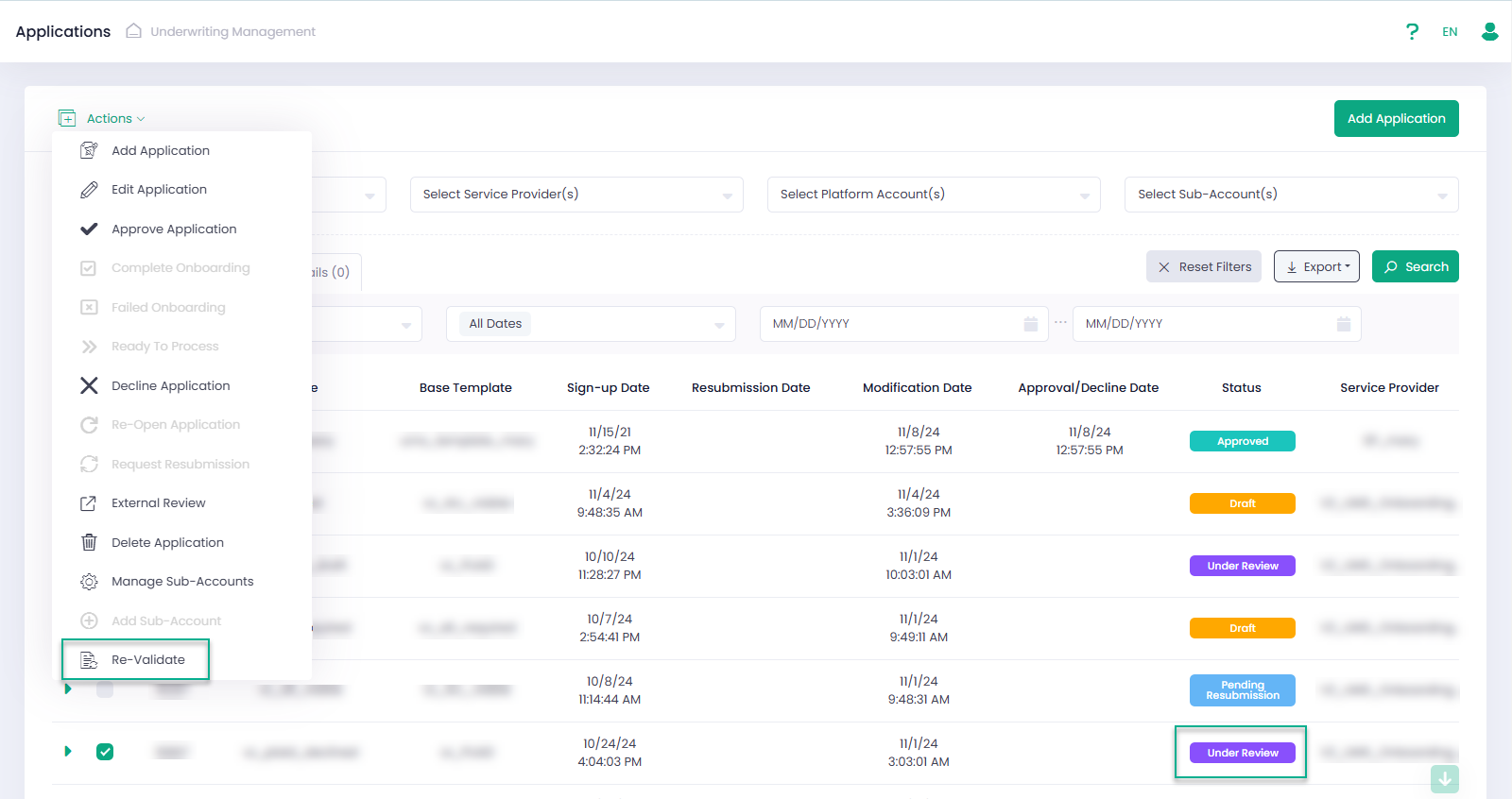

The authorized Users can manage Underwriting Applications through the actions or context menu. Actions on the entire Underwriting Application can be performed and/or specific fields/documents can be approved/declined in the details view of the selected Underwriting Application.

Actions on specific fields do not affect the Underwriting Application general status!

Underwriting Application Resubmission

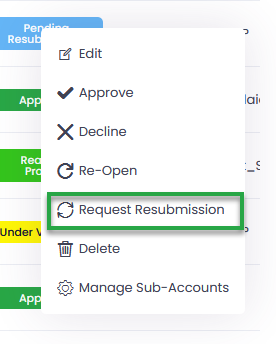

Authorized Users can re-enter declined fields of the selected Underwriting Application by initiating Request Resubmission action from the actions or context menu. The Request Resubmission action is available only for Underwriting Applications that have one of the following statuses: Declined, Under Review, Pending Resubmission and at least one declined field.

Once the Request Resubmission action is selected, the User can choose either to send a direct email with a link to the UMS resubmission page to the contact email address or to copy a link from the pop-up. The link to the UMS resubmission page has unlimited lifetime but works only once, thus, a new resubmission request is required after the authorized User has submitted the form using the linkg of the resubmission page.

Underwriting Application Re-Validation

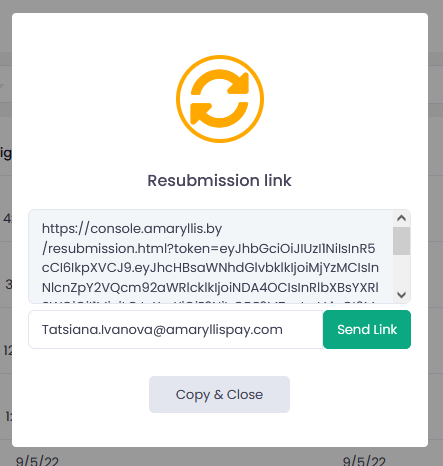

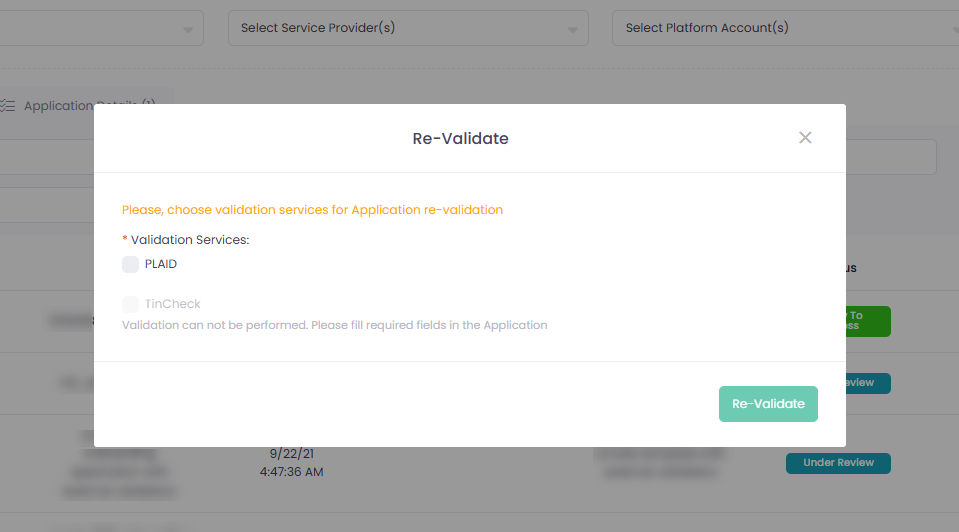

Applications in “Under Review” status can be re-validated by specific external validation services. Authorized Users can initiate “Re-Validate” action from menu.

After the re-validation pop-up opens, you can choose the validation service for re-validation. In case required fields for validation services are missed in the Application, the relevant checkboxes will be disabled in the re-validation pop-up. Following the Application should be edited, and mandatory fields should be filled in.

UMS Resubmission Form

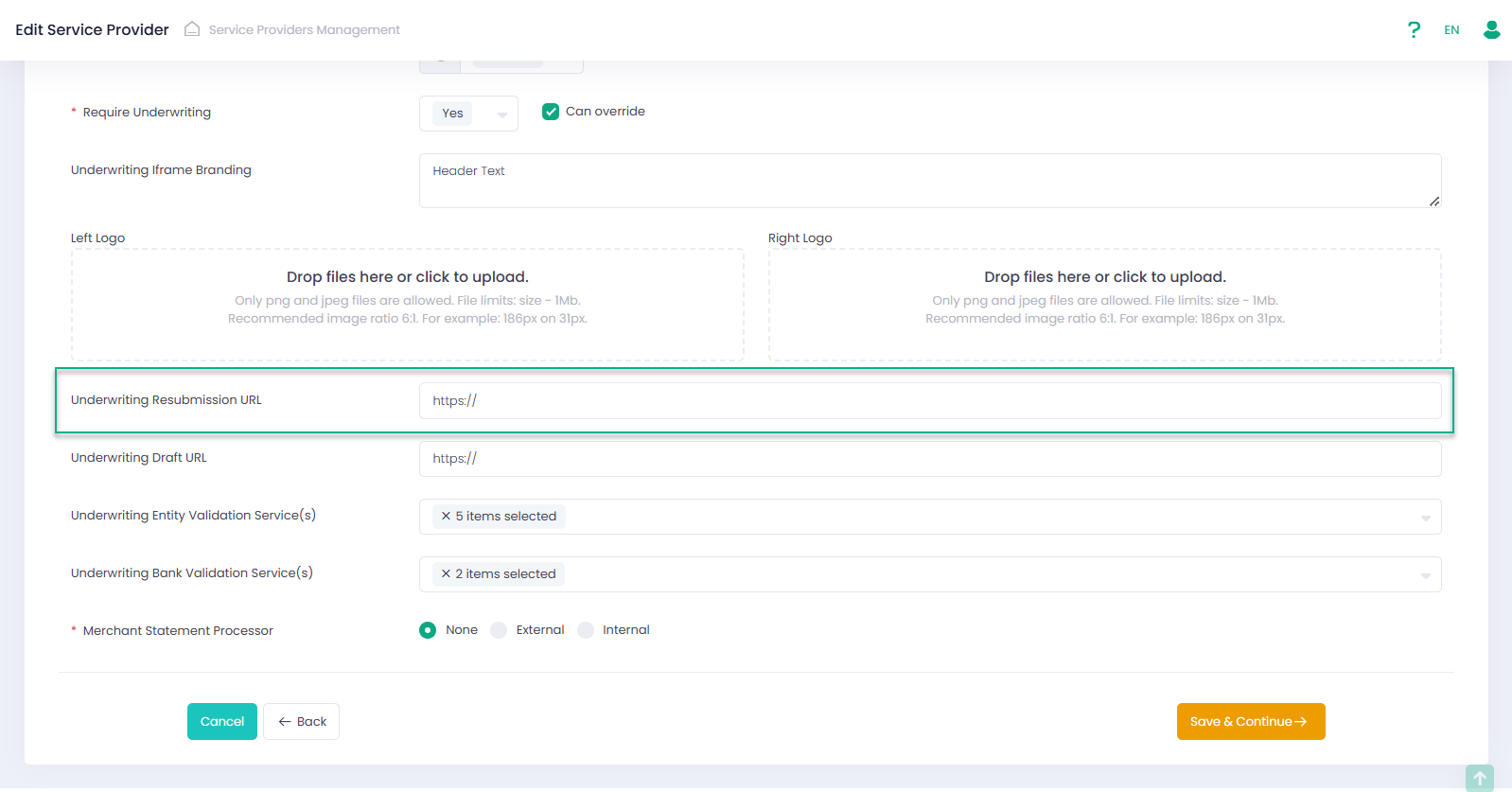

If declined fields require revision, a User can initiate UMS Application Resubmission using Request Resubmission in the Actions Menu. In this case a link to the UMS Resubmission page is displayed. It is opened/displayed in a separate page depending on the Service Provider settings.

Underwriting Application Statuses

An Underwriting Application may have different statuses throughout its lifecycle:

- Under Review – new and not (yet) approved Underwriting Application

- Approved – Underwriting Application approved by the authorized Users or following an automated process

- Declined – Underwriting Application declined by the authorized Users or following an automated process

- Under Validation – Underwriting Application is under external validation

- Pending Resubmission – request for resubmission of the Underwriting Application was initiated

- Onboarding In Progress – Application is locked due to onboarding to a processor

- Onboarding Completed – Underwriting Application onboarding (to the Processor) has been completed

- Ready to Process – Underwriting Application is ready to process (a Sub-Account has been created)

- Onboarding Failed – onboarding of an Underwriting Application has failed

- Sub-Account Creation In Progress – Application is locked due to automatic Sub-Account creation

- Sub-Account Creation Failed – automatic Sub-Account creation has failed

- Draft – partially filled Underwriting Application which is not yet submitted

- Under External Review – Underwriting Application sent for external review

Underwriting Application Notifications

Authorized Users can configure notifications for the Underwriting Applications that are sent from the Service Provider/Operator email. Events that trigger notifications are set at the Undewriting Template level.

Underwriting Application fields status updates are checked daily, while Underwriting Application statuses updates are updated instantly

Linking Sub-Accounts to Underwriting Applications

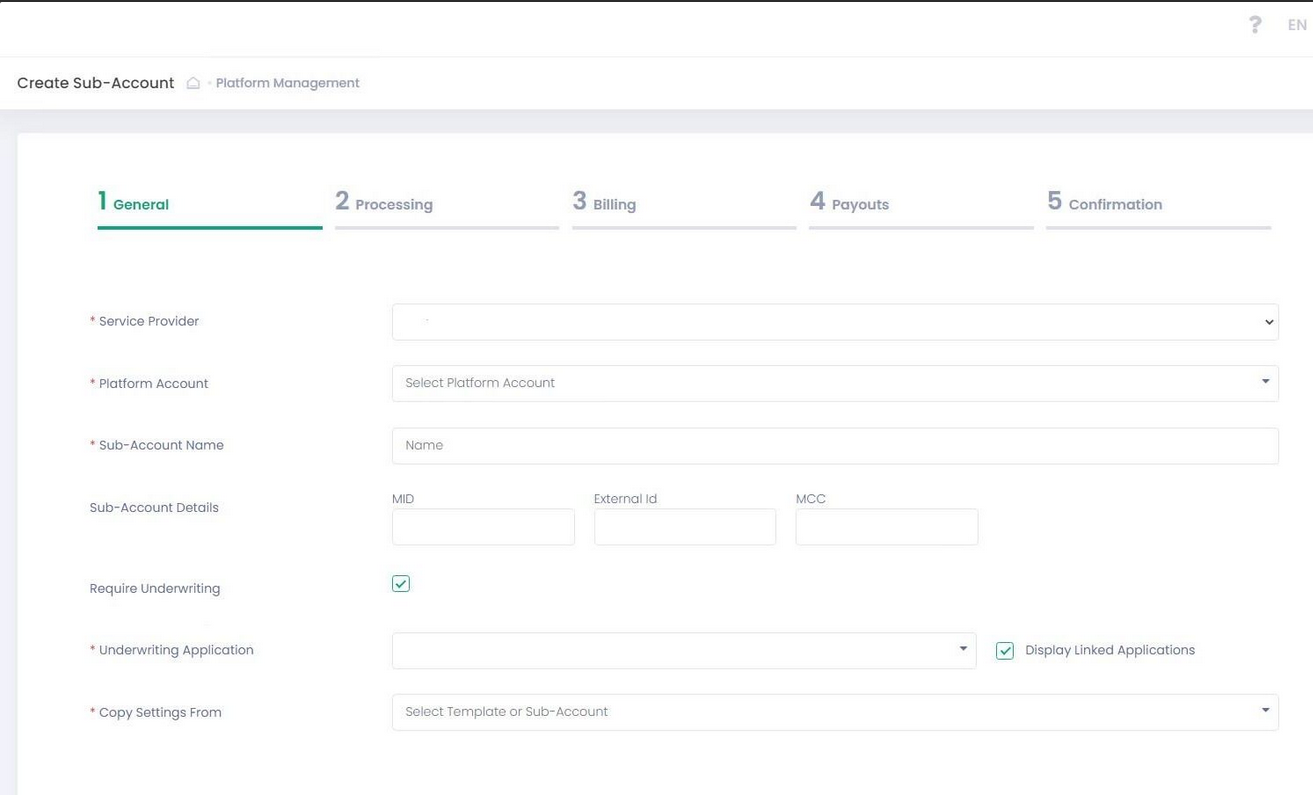

It is possible to create a new Sub-Account right from the Underwriting Application page and automatically enable a specific Underwriting Application for this new Sub-Account.

Use Add Sub-Accounts command in the actions or context menu to open the Sub-Account Onboarding Wizard. The overall flow is identical to the one described in the Sub-Accounts Management section. The only difference is that a new Sub-Account gets this specific Underwriting Application automatically attached and underwriting is enabled.

In addition information completed in the Application relevant for the sub-account creation, such as bank account information, is completed automatically based on the Application data.

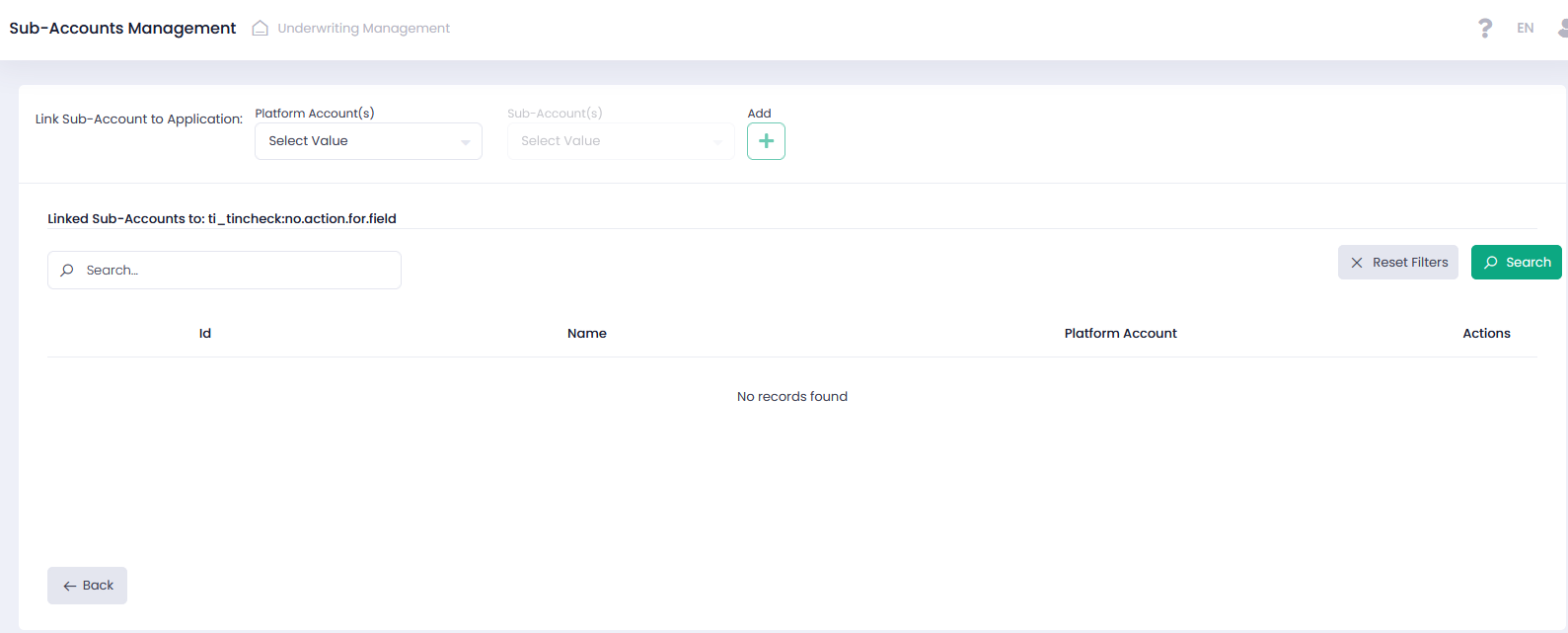

In addition, it is possible to manage an Underwriting Application linked to Sub-Accounts through the Manage Sub-Accounts command in the actions or context menu. On this page, authorized Users can link any existing Sub-Account to an Underwriting Application or otherwise unlink any already linked Sub-Account therefrom.