Service Provider Configuration

Service Provider Onboarding Wizard

Service Provider onboarding is a seven-step procedure that allows to create and/or edit Service Provider entities. The procedure consists of the following steps:

- General

- Processing Information

- Interchange Fees

- Fees & Residuals

- Payout Banks

- Billing

- Payouts

- Press the Save & Continue button to save settings at the current step and proceed to the next step.

- Press the Back button to return to the previous step without saving settings at the current step.

- Press the Cancel button to abort onboarding without saving.

- Press the Submit button to save all settings and complete the onboarding procedure.

Information Requirements

Before setting up your Service Provider, you should have the following information of the Service Provider available:

- Service Provider color scheme, icon, and logo

- Processors to be used

- Credit card types

- Applicable Interchange Fees

- Fee structure, fee names, amounts

- Payout Bank Details (for payouts to the other entities)

- Service Provider Payout Bank (for receiving payouts)

Let us configure a Service Provider!

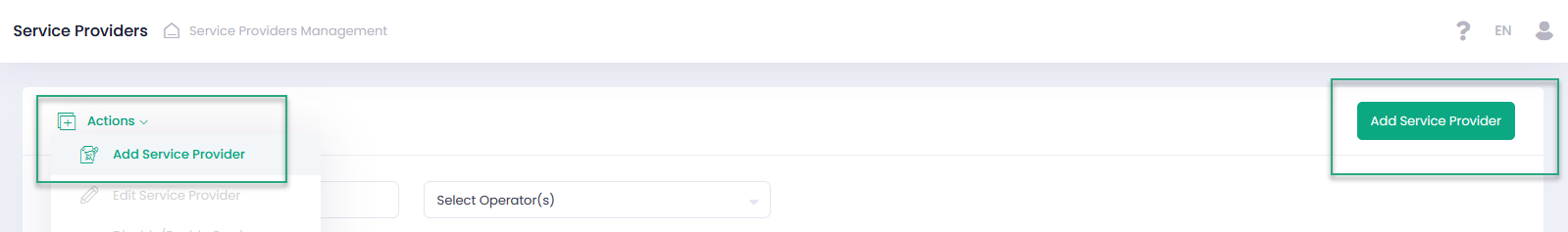

- Go to the Service Provider section

- Click ‘Add Service Provider’

- Follow the seven-step Service Provider Onboarding Wizard to create a new Service Provider

OR

- Select at least one Service Provider

- Select ‘Add/Edit Service Provider’ in the Actions pop-up options list

- Follow the seven-step Service Provider Onboarding Wizard to add/edit a new Service Provider

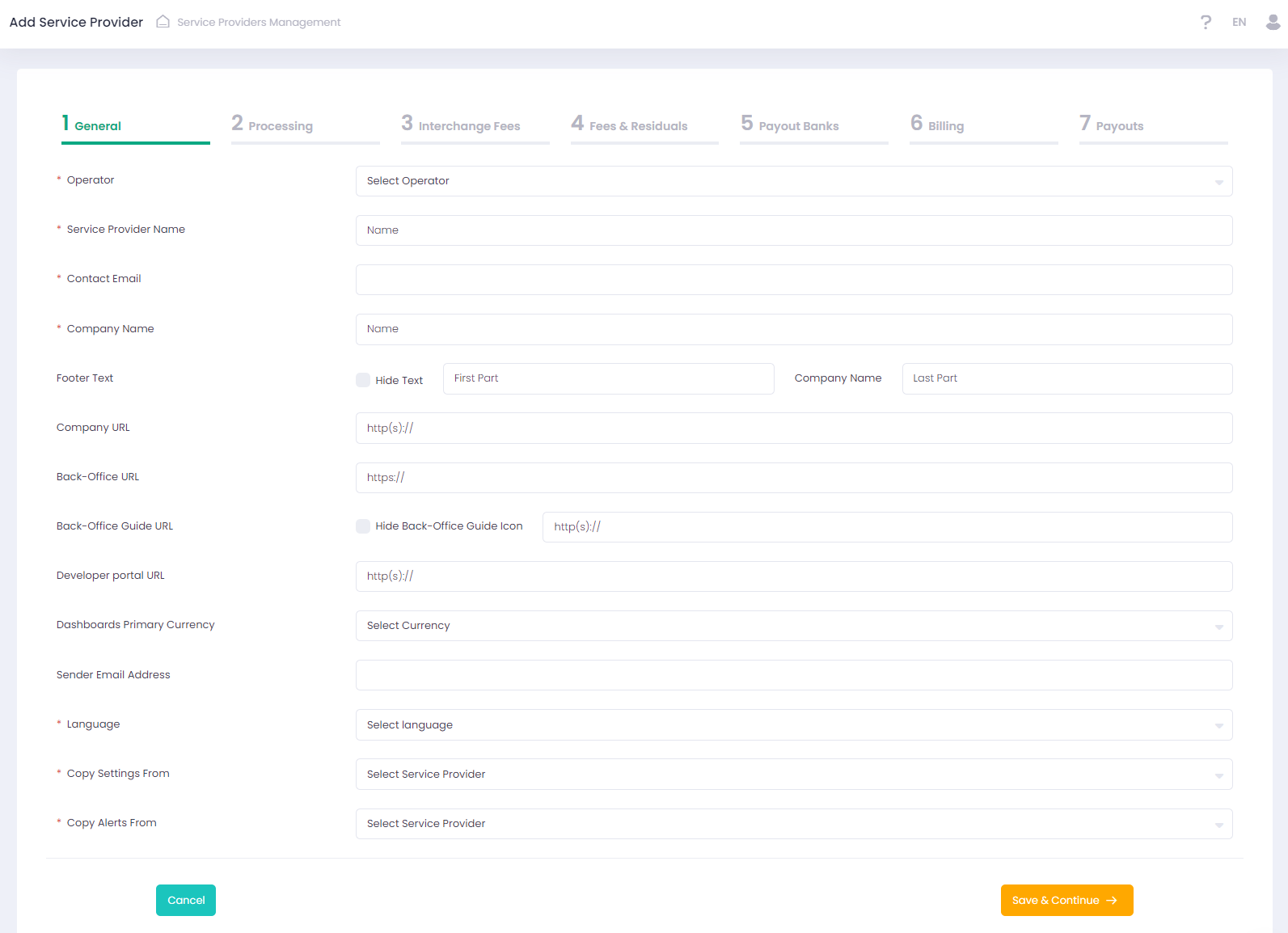

Provide all the general information that will determine the way your Service Provider Entity will be displayed in the system.

| Name | Description | Optionality |

| Operator | Your Service Provider will be subordinate to this Operator | Required |

| Service Provider Name | Service Provider Company Name that will be displayed in the Back-Office | Required |

| Contact Email | Service Provider contact Email address | Required |

| Company Name | Service Provider Company name that will appear in the page footer | Required |

| Footer Text | Activate Hide Text to hide footer text entirely. Footer text can be edited before and/or after the Company Name. In case it is omitted, values are inherited from the parent system entity or default settings are applied | Not Required |

| Company URL | Service Provider Company URL that will appear in the page footer | Not Required |

| Back-Office URL | This URL is provided in the registration email with the user credentials, that is sent to users upon their registration. In case it is not filled in, the default Back-Office URL is applied | Not Required |

| Back-Office Guide URL | This URL is provided in the registration email with the user credentials, that is sent to users upon their registration. In case specified, the provided values replace URL that is sent to users by default in the registration email, Back-Office help icon hyperlink value. In case it is not filled in, the default Back-Office User Guide URL is applied | Not Required |

| Developer Portal URL | The Developer Portal URL is located in the User profile section | Not Required |

| Dashboards Primary Currency | The currency that will be set as default for the dashboard currency filter. | Not Required |

| Sender Email Address | Email address that will be used for sending emails. In case it is not filled in, the default Operator Sender Email address is applied | Not Required |

| Language | Select an interface language from the list of available languages | Required |

| Color | Theme color used for Back-Office display | Required |

| Icon | Service Provider Theme FAV Icon used for Back-Office display | Not Required |

| Logo | Service Provider Theme Logo used for Back-Office display | Not Required |

| Copy Settings From | Select a source Service Provider to copy configuration settings to a new target Service Provider. Select None to disable all templates. Enabled for the Add Service Provider form only | Required |

| Copy Alerts From | Select a source Service Provider to copy alerts settings to a new target Service Provider. Select None to disable all templates. Enabled for the Add Service Provider form only | Required |

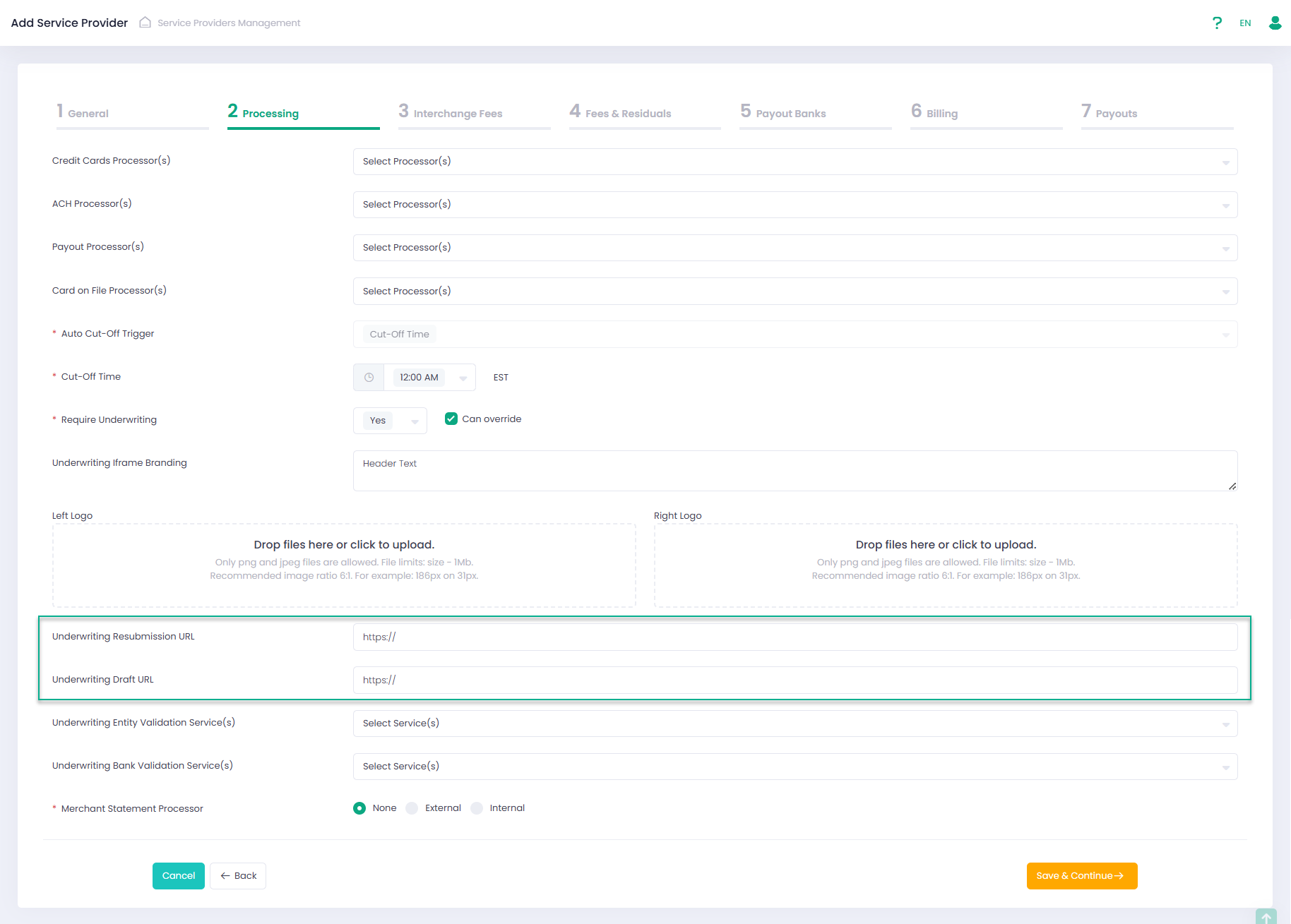

At this step, set your Service Provider transactions processing configurations and determine

- Credit card processors

- ACH processors

- Payout processors

- Card On File processors for negative payouts for Sub-Accounts Payout processors

The selected processors will be in the available options for Platform Accounts and Sub-Account that will be created under this Service Provider.

Click each text area to show all the available options. You can select more than one option in each field.

Configuring Credit Card Processing Options

Determine your Supported Credit Card(s). You can select more than one credit card type. The Credit Card Types you select here will be displayed as available Credit Card options for your Sub-Accounts configurations and for your Reports.

Cut-off time administration

Auto Cut-Off Trigger enables to configure the Cut-Off time based on a specific trigger. Currently it is possible to trigger on cut-off time with available time steps of 1 hour.

A Cut-Off time can be set for each entity individually. However, if no cut-off time is set the entity will inherit the cut-off time settings of its parent entity, e.g., a Sub-Account will inherit the settings of a Platform Account. In case parent entity cut-off value is not set, then the cut-off time is set at 12:00 AM EST

Underwriting Settings

Configure Underwriting settings for the subordinate Sub-Accounts:

- Require Underwriting — set yes to enable underwriting when onboarding Sub-Accounts

- Can override — activate to enable Sub-Account overriding underwriting settings

- Underwriting iframe Branding — in this section you can set the following Underwriting Application branding details:

- Header Text

- Left Logo

- Right Logo

Enter the Underwriting Resubmission URL to be used for the Underwriting Application resubmission page.

Enter the Underwriting Draft URL to be used for the Underwriting Application draft page.

If you want to connect to Underwriting Entity Validation Services or Underwriting Bank Validation Services, select them in the corresponding fields. The services you select here will be displayed as available at the External Validation step of the Underwriting Template wizard.

Merchant Statement Configuration

Choose your Service Provider Merchant Statement Processor. Available statements are displayed in and can be downloaded from the Merchant Statement Report. Users have access to the Merchant Report based on their permissions level. There are three Merchant Statement Processor options:

- None — no additional logic is implemented

- External — you are given an option to select a Statement Issuer from the list of available processors. In this case the merchant statement report is supplied by the third party

- Internal — you can configure a merchant statement report using a list of provided parameters (Statement Issuer, Statement Day of Month, Statement Language, Statement Color, Statement Logo, Statement Issuer Name, Statement Issuer Address, Statement Issuer City, Statement Issuer ZIP, Statement Issuer County, Statement Issuer Phone, Statement Issuer Email, Statement Glossary Terms).

You can select only one of the available options!

Configured merchant statement report parameters are available for preview in the Service Provider Details/Processing Settings tab.

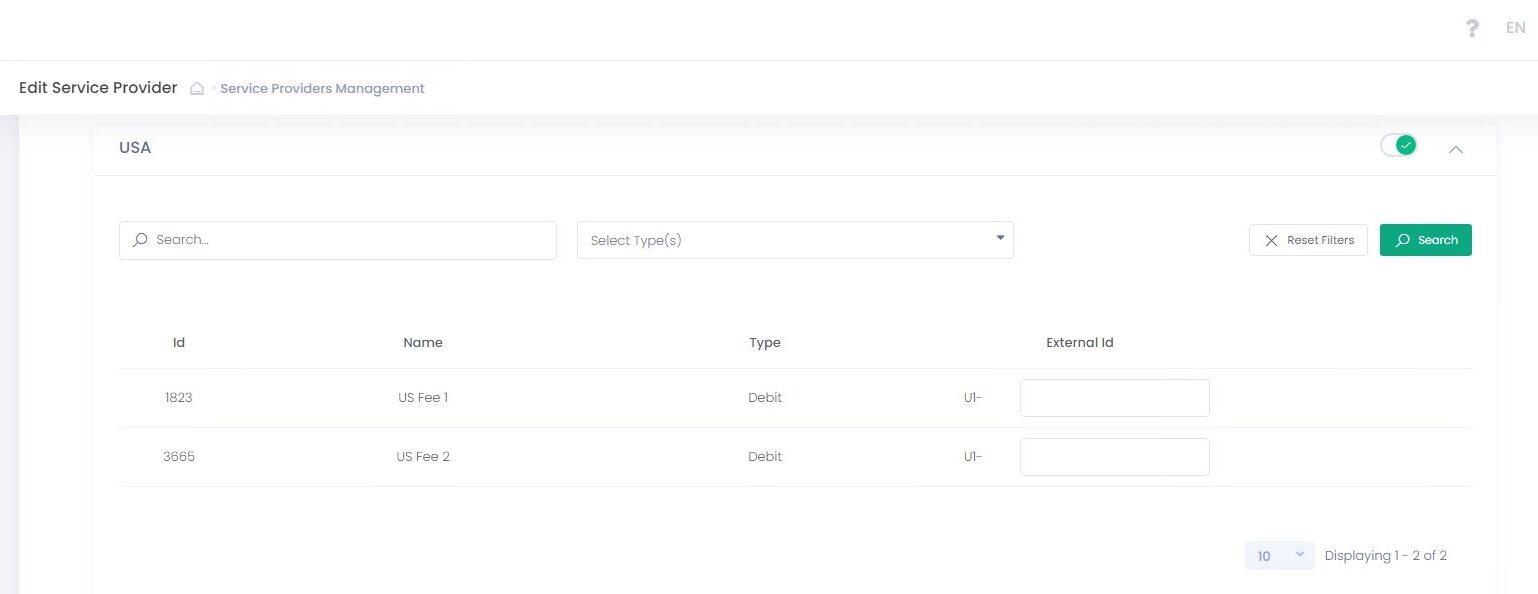

Interchange Fees is an Optional step. If you want to skip this step, do not activate any Interchange Fees, and click ‘Save & Continue’ to proceed to the next step. All available Interchange Regions are displayed in this section. Expand each region to preview all the configured fees for this region.

Activating Interchange Fee’s

Use toggle to activate an Interchange Fees Region(s) that you require from the list of available Interchange Fee Regions.

The Interchange Fee will be identified by the System Id (Id). If you want to use your own ID, you can do so by using the External Id field:

- Use filter to search for the Interchange Fees you want to configure, enter fee name if you know it, and/or choose Debit or Credit fee type.

- Enter your own Id in the External Id field for the relevant Interchange Fees.

Interchange Fee Regions Functionality

You can perform the following actions on active Interchange Fee regions:

- Select Fee Target from the drop-down to assign the entity that will receive the Interchange Fee.

- Select Billing Date Delay to set a billing date delay for the Interchange Fee.

- Mark the Interchange Fee as External Cost. See ‘Mark as Cost’ in the ‘Fees Configuration Details’ section for more information.

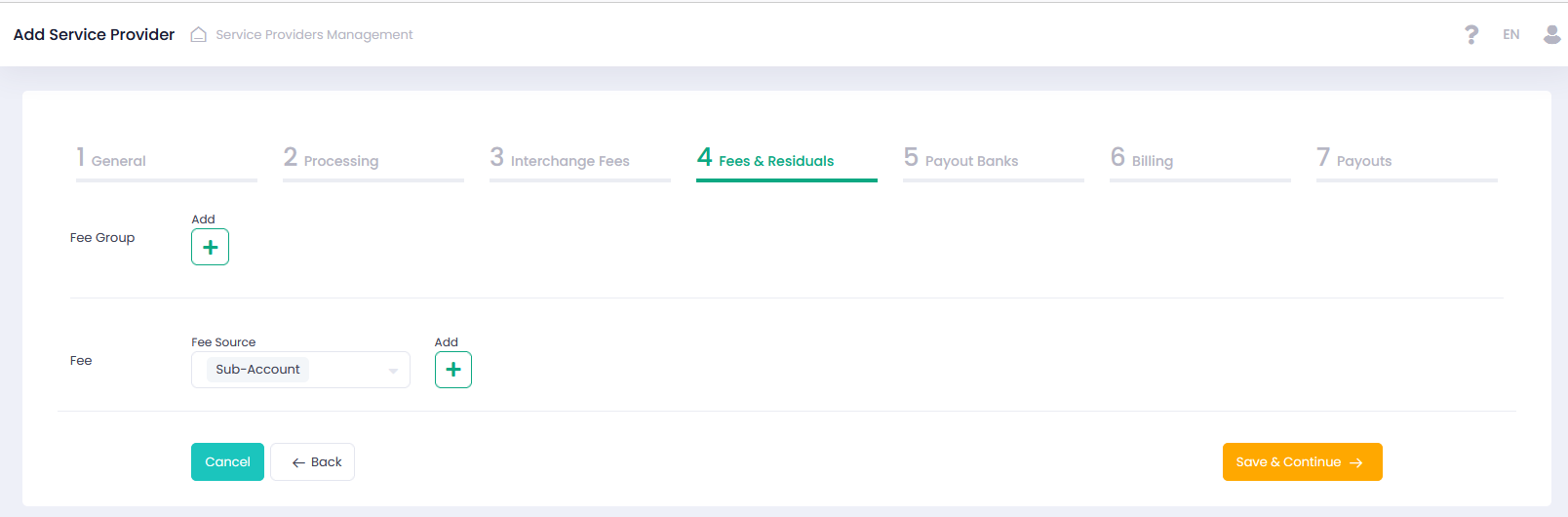

*At this step Fees and Fee Groups are configured. This step only defines the combination of parameters that should be used for each fee. The actual individual fees values will be configured at the sub-account level individually based on the settings that you create at this step.

Please create:

- Fee Groups — to split fees between multiple recipients.

- Fees – Stand-alone (individual) fees.

To create a Fee Group:

- Click Add (+).

- Enter Fee Group Name. This is the name of the fee that will be displayed at the Sub-Account level.

- Select one of the Fee Types (Per Transaction Fee, Scale Range Fee, Scheduled Fee). Please note, once a fee group has been created you cannot change the Fee Type parameter for this fee group.

- If applicable, enable Mark as Tax. As a result, all Fees in this group will be Marked as Tax.

- If required, click Remove to discard the Fee Group.

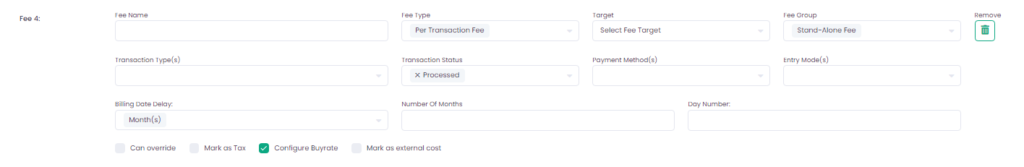

To create or edit a Fee:

- Select a Fee Source and click Add (+) to add a new fee section

- Navigate to the newly created fee section.

- Enter a Fee Name. This is the name of the Fee that will be displayed in the Back-Office. In case the Fee is a part of a Group, the Fee Group name will be displayed at the Sub-Account level.

- Select Fee Type from the list.

- Select a Fee Target – available options depend on the selected Fee Source

- Select Stand-Alone Fee for a single Fee or one of the Fee Groups that you have created in the previous section for a Fee belonging to a group Fee.

- Select one or more Transaction Type(s) from the list of available transaction types. Not relevant for Scheduled Fee and Fee on Top of Fee.

- Select Transaction Status – create Fees for both successful and/or declined transactions. Not relevant for Scheduled Fee and Fee on Top of Fee.

- Select one or more Payment Method(s) from the list of available payment methods, if left empty, the Fee will apply to all payment methods. Not relevant for Scheduled Fee and Fee on Top of Fee.

- Select Entry Mode from the available list of entry modes, if left empty the Fee will apply to all entry methods. Not relevant for Scheduled Fee and Fee on Top of Fee.

- Select Payment Type from the available list. This field is required.

One Off Payment – a payment that occurs ones and only ones and is not part of a regular process or sequence.

BNPL – a type of short-term financing that allows consumers to make purchases and pay for them at a future date.

Recurring Payment – a payment that repeats multiple times on a specific date range and is charged on a periodic basis

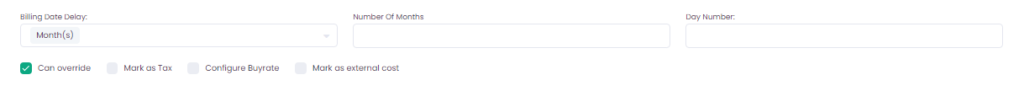

- Select Billing Date Delay to delay the execution of the Fee to a future date and specify Fee delay parameters, otherwise choose Real-Time to execute the Fee in real time. Not relevant for Scheduled Fee.

- Enable Can override to allow overriding the fee values at the Sub-Account level.

- Enable Mark as Tax to identify the Fee category as Tax. Skip to identify fee category as Fee.

- If required, click Remove to discard the Fee.

- You cannot remove a Fee that has already been used.

- Enable Configure Buyrate to configure for a Fee a Buyrate portion for a Buyrate Target.

- Enable Mark as external cost to display in the Profitability Analysis Report of the Fee Target under Transaction Cost Amount and affect the overall Profit Amount.

- Optional: Configure what Users and/or User Roles can edit one or more Fee parameter(s) in the Sub-Account, Platform or Agent wizards

- Optional: Enter External Fee Ids while configuring fees of the Per Transaction Fee type with Can Override enabled.

Reserve Configuration

Reserve Release Date Delay

Reserve Release Date Delay enables you to customize your reserve balance release settings.

Reserve Balance Limit

Reserve Balance Limit enables you to limit the total amount of Reserve Balance you will keep. If Reserve Balance is selected as Fee Target, the Reserve Balance Limit input field will appear so you can specify the limit amount for that fee. In case a limit is set, the system will check the reserve balance before applying the reserve fee. If the reserve balance is greater or equals the preset limit value, the system will not apply the reserve fee. Reserve Balance Limit is specified per reserve fee and per Service Provider and does not depend on currency. The limit value can be different for different reserve fees.

Billing Delay

Billing Date Delay enables you to delay billing of your fee, instead of real-time (immediate) billing. In the Billing Date Delay settings, you can specify the delay time span. Values provided in this step will be available as default billing date delay settings for relevant Sub-Accounts billing settings and will not be displayed at the Sub-Account Billing Onboarding step.

| Name | Description |

| Dayes | Enter the Number Of Days value to determine a fee daily billing delay time span |

| Weeks | Enter Number Of Weeks value to determine a fee weekly billing delay time span and On value to select a billing weekday |

| Months | Enter Number Of Months value to determine a fee monthly billing delay time span and Day Number value to select a billing sequential calendar day |

| Years | Enter On value to determine a fee billing month and Day Number value to select a billing sequential calendar day |

| Real-Time | Select for real-time billing |

Buyrate Configuration

Buyrate enables you to configure for a Fee a Buyrate portion for a Buyrate Target. Note that in case Buyrate is configured, the Buyrate portion will apply first before any other fee portion calculations are made.

Buyrate option can be enabled for Per-Transaction, Fee On Top Of Fee , Sliding Scale Fees.

Conditions for using Buyrate:

- Fee Source = Sub-Account

- Fee Target options: Sub-Account, Agent, Platform, Service Provider. Operator and Reserve Balance cannot be targets for Buyrate.

In case enabled, the users can configure a Buyrate fee value for a Buyrate Target and a Total fee value at the Sub-Account level.

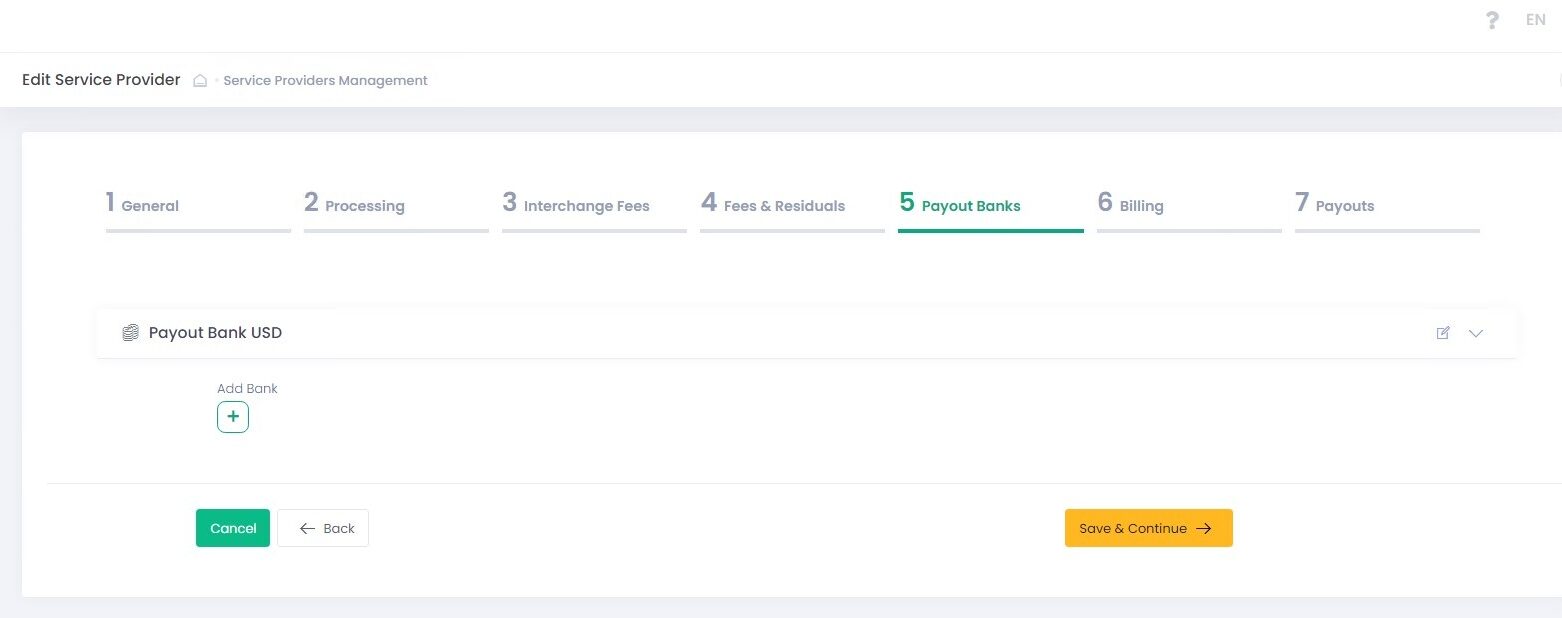

Payout Bank Details

At this step you can create Payout Bank(s) for your Service Provider. Payout Banks are banks that will be used to make payouts for all system entities. Service Provider is the System Entity that manages all pay-ins and pay-outs.

Payout Banks for Platform Accounts and Sub-Accounts are determined automatically based on the Service Provider settings and currency type configured for each Sub-Account.

Configuring a Payout Bank

- Click Add to add a new Payout Bank

- Click Edit to edit a Payout Bank Name

- Fill in the Payout Bank form and click Submit to complete the Service Provider onboarding process

- Click OK to confirm new Service Provider onboarding

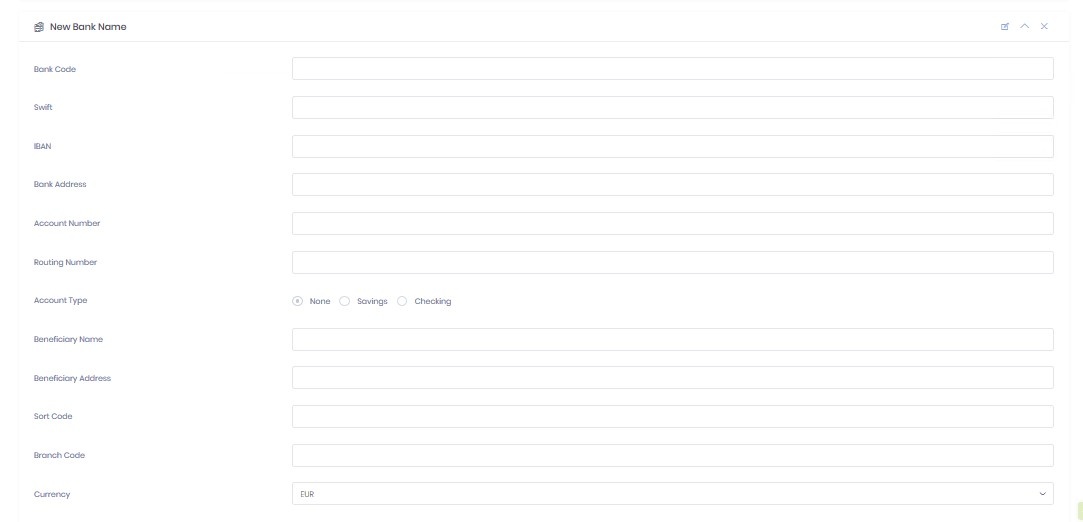

Add/Edit Payout Bank Form Details

| Name | Description |

| New Bank Name | The name of the Payout Bank as it will be displayed in the Back-Office |

| Bank id | It is created by the System automatically after you create a Payout Bank |

| Bank Code | A Bank Code is a unique identification code for a particular bank |

| SWIFT | SWIFT is an 8- or 11-digit code that identifies your country, city, bank, and (11-digit only) branch |

| IBAN | IBAN (International Bank Account Number) is an international bank account number used to identify bank accounts. The number starts with a two-digit country code, then two numbers, followed by several more alphanumeric characters |

| Bank Address | Enter the official address of your payout bank |

| Account Number | Enter full bank account number |

| Routing Number | A nine-digit number used to identify a financial institution in a transaction |

| Account Type | Select Checking or Savings account type |

| Beneficiary Name | The name of the person or a company receiving the funds |

| Beneficiary Address | The address of the person or company receiving the funds |

| Sort Code | A six-digit number that identifies both the bank and the branch where the bank account is held |

| Branch Code | A six-digit number. Identifies both the bank and the branch where the account is held |

| Currency | Select currency type from the drop-down list |

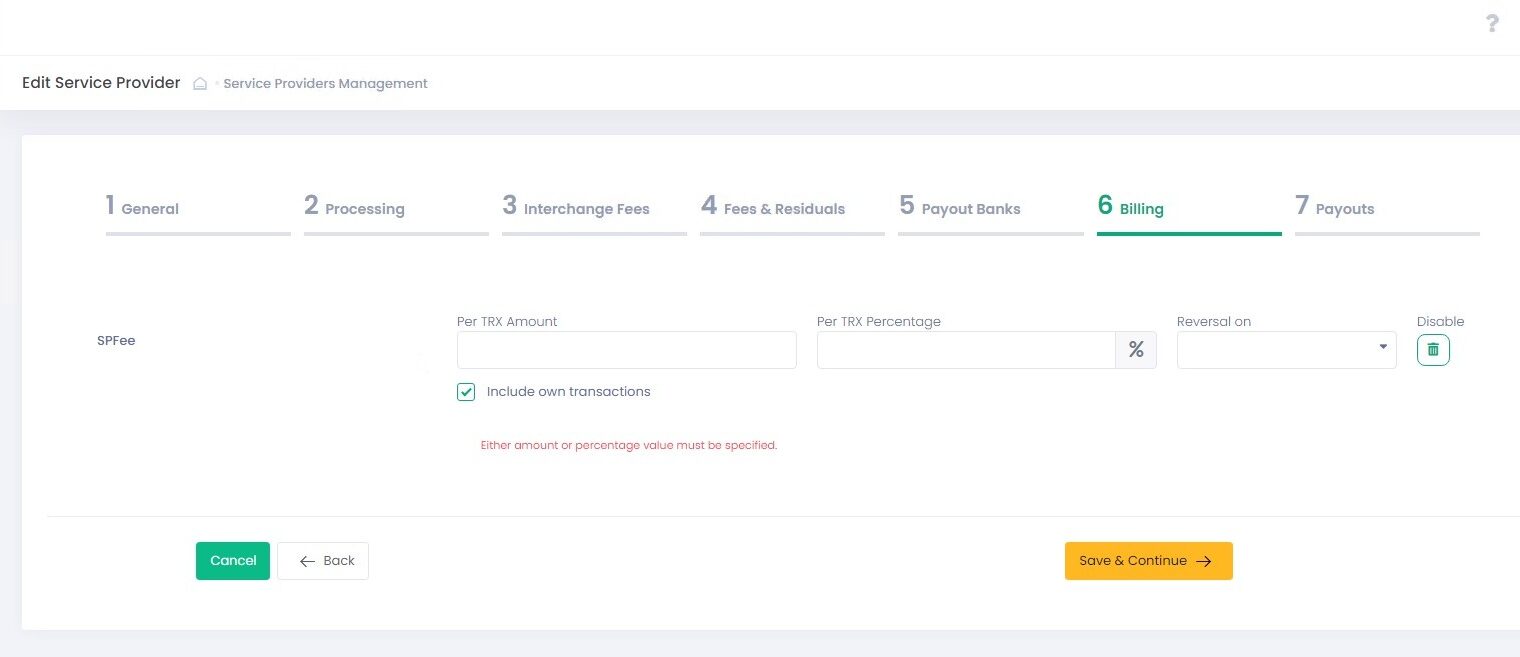

Fees created at the Fees & Residuals step with Fee Source=Service Provider appear at the Billing step. Specific values for these fees are configured at this step.

Service Provider Fees follow the same logic as Sub-Account Fees with a few exceptions: (See Sub-Account/Billing Wizard section for more details about configuring Fees and their parameter values)

- Fee Target = Operator or Agent

- Fees are always Stand-Alone Fees; Group Fees are not available

- Buyrate cannot be configured for the Service Provider Fees

- Priority levels are not available for the Service Provider Fees

- Option to choose ‘Include Own Transactions’:

- If ‘Include Own Transactions’ is marked, the Service Provider’s own transactions and its subordinate transactions will trigger the fees.

- If ‘Include Own Transactions’ is not marked, only the transactions processed by the Service Provider’s subordinates will trigger the fees.

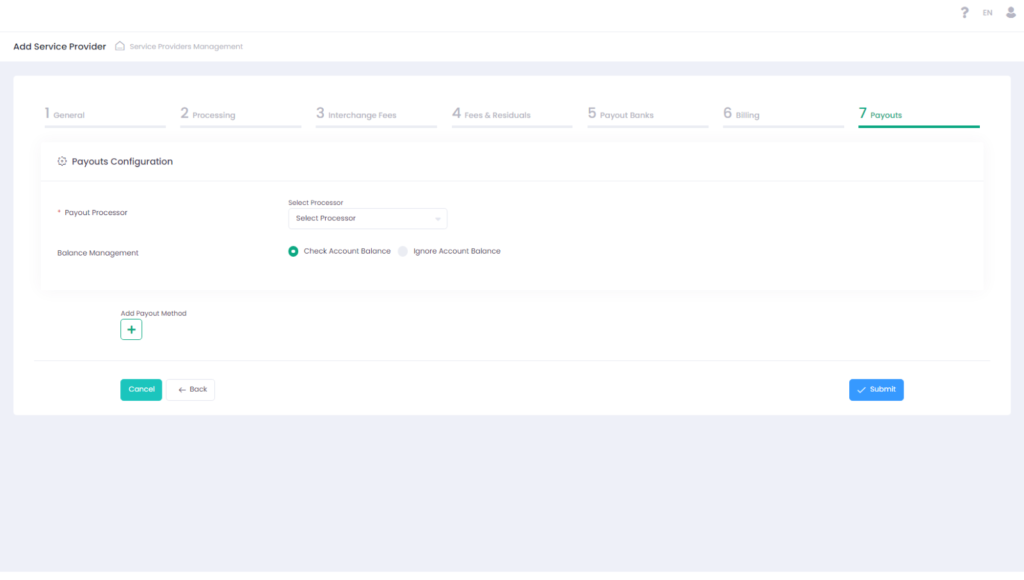

In this section you can configure manual or automated payout options, payout processor and specify external payouts processor parameters.

Payouts Configuration Details

| Parameter | Description |

| Payout Processor | Select a Payout processor from the drop-down list or select None to enable manual payouts. Available options are based on the selected Service Provider. External payouts processor is disabled if manual payout (None) option is selected. Manual payouts are manually approved in the Back-Office Payouts report |

| Processor Parameters | Parameters are pre-populated individually for each Payout processor |

| Balance Management | Balance Management allows configuring payout actions based on the balance value |

| Check Account Balance | Select to enable account balance check prior to the payout. In case enabled, negative payouts are disabled |

| Ignore Account Balance | Select to ignore account balance value for processing payouts. Required to enable negative payouts |

| Perform Negative Payout (Withdrawal) | If Account Balance is negative (in case selected together with Ignore Account Balance) and the returned account balance calculated amount is negative – negative payout transaction is processed |

Configuring Payouts for a Service Provider

Create and configure individual payout instructions for your Service Provider. Create payouts, following your business requirements. All available actions are as follows:

- Add Payout: use to add an additional payout

- Edit Payout Method Name: use to edit an existing payout name

- Hide/Show: use to hide/show a payout configuration

- Remove: use to delete a payout configuration

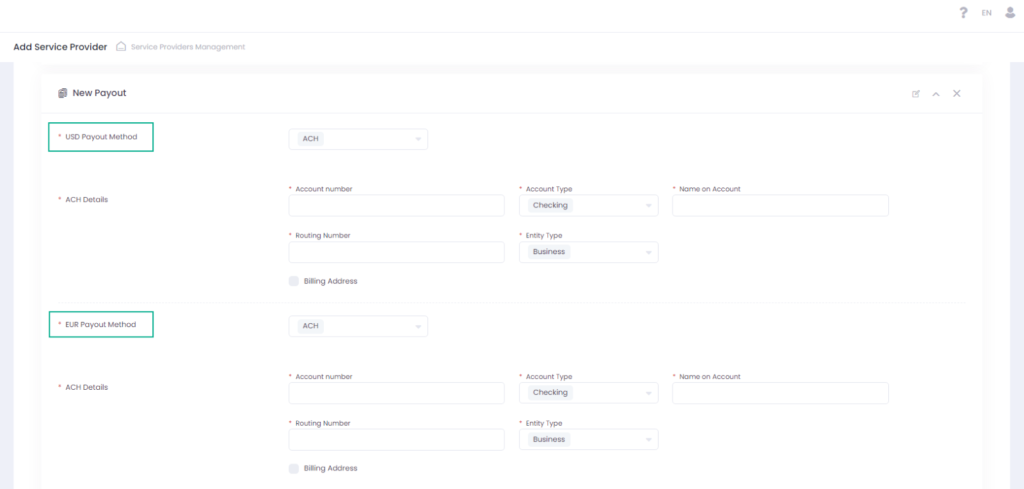

Payout Bank details

Create one payout configuration per currency type.

Payout Schedule

Create a payout instruction in this section. You can preset payout amount calculation mode and time range to create a rolling reserve according to your risk management policy.

| Name | Description |

| Payout Method | Select a Payout Method for the payout from the drop-down list. Select None to skip creating a payout instruction for a specific currency. Select ACH to create a payout instruction for a specific currency. |

ACH Details All fields are required Displayed in case ACH is selected |

|

Payout Scheduler Automated Payout Interval Options |

|

Payout Scheduler Automated Payout Expiration Options |

|

Payout and Reserve Management Payout Amount Calculation Methods |

|

| Two-Step | Select to enable an additional manual payout confirmation via the Back-Office |

| Approval (semi-automated payout) | Use to add a manual payout approval for automated payouts processed with an external processor or to add an additional manual approval for manual payouts |

| Payout Time | Time picker to set the payout timing |

| Scheduler state | Select to enable/disable payout scheduler |