Underwriting Application

What is an Underwriting Application?

Underwriting Application is a form to be filled out by the merchant to enable the Processor (Service Provider/Operator) to verify the merchant information in order to issue approval for a merchant account.

Each Underwriting Application is created for a specific Service Provider.

Underwriting Applications are created based on the pre-configured Underwriting Templates, all Application fields displayed are determined by the Underwrtiting Template used.

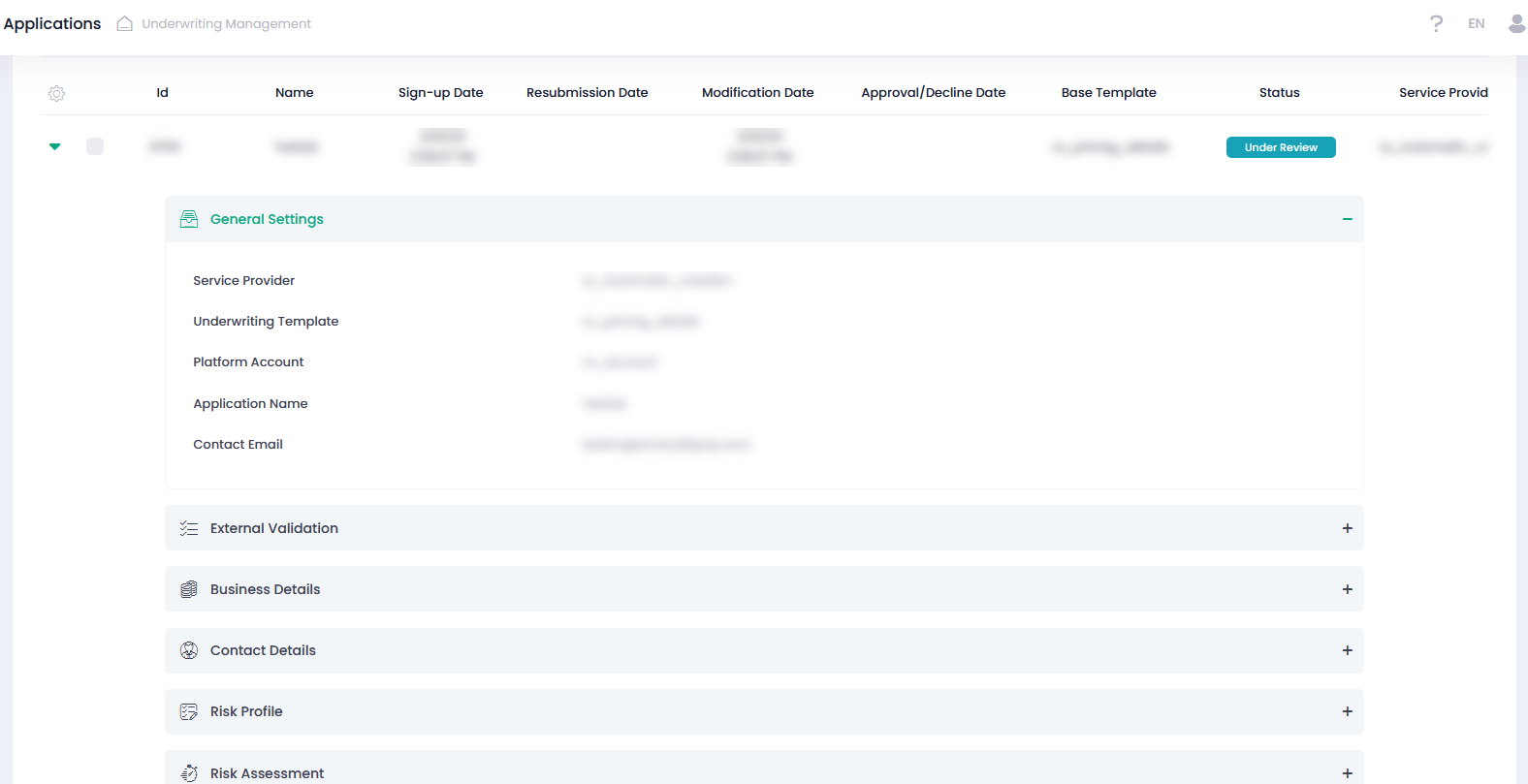

When a potential merchant submits a new Underwriting Application, it can be viewed and managed by authorized Users on the Underwriting Applications’ page.

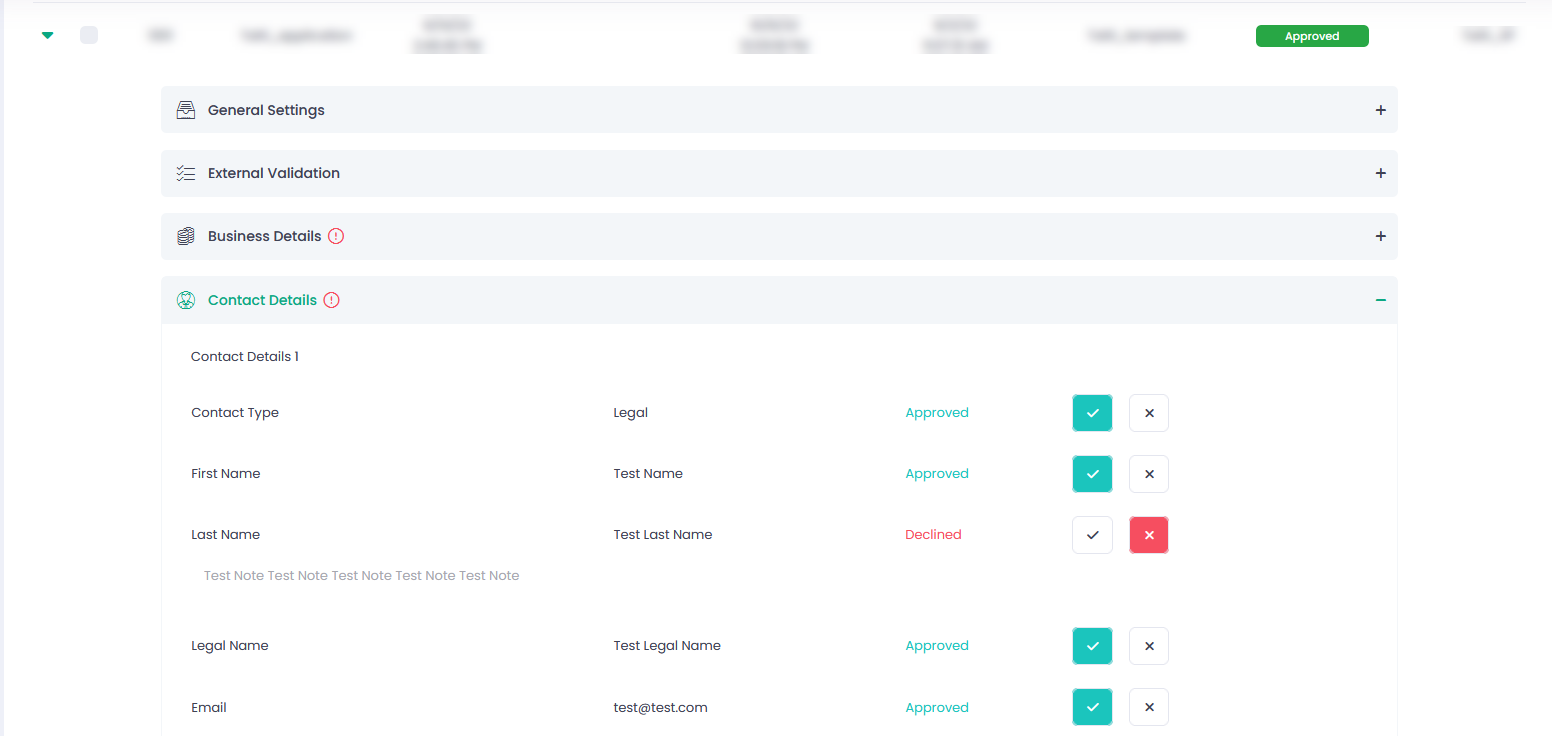

On this page, the authorized Users can perform a variety of actions on the selected Underwriting Applications : create, edit, approve, complete onboarding, set ready to process, decline, re-open, delete, request resubmission, set for external review, re-validate and create new Sub-Accounts.

Actions on specific Application fields do not affect the Underwriting Application general status!

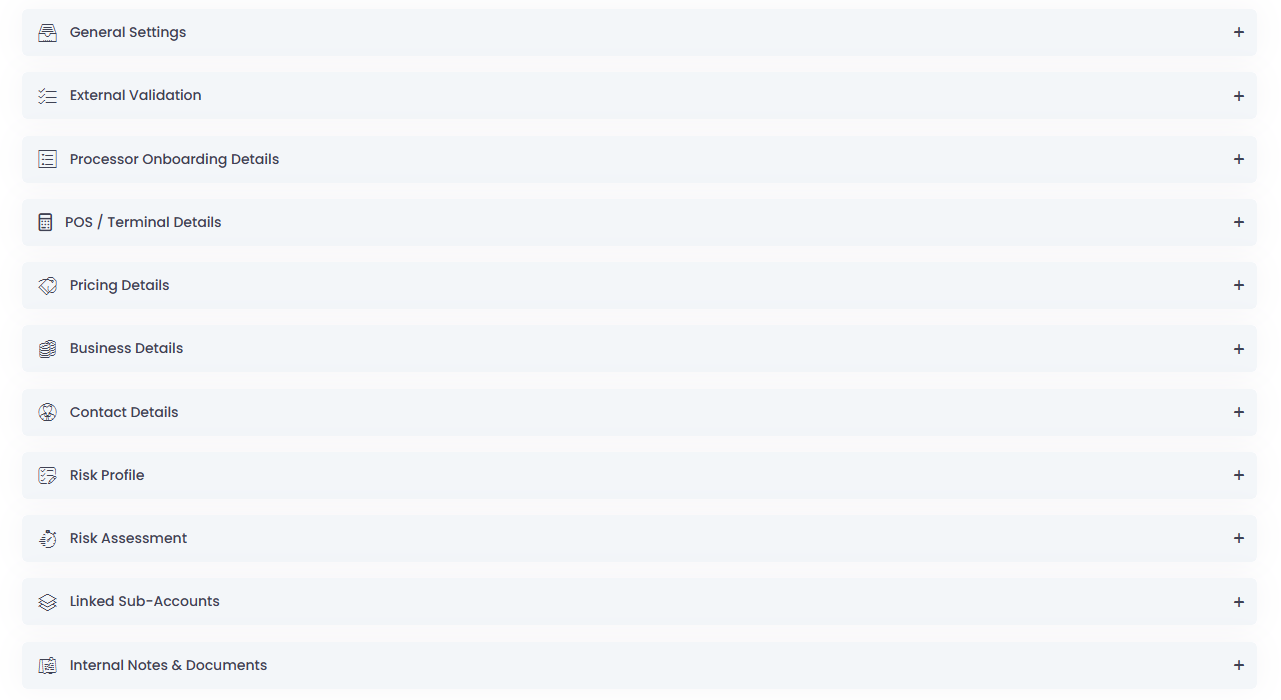

The following categories of information can be covered by the Underwriting Application and be seen in the view mode:

- General Information: relevant Service Provider, Underwriting Template name, Underwriting Application name, contact Email.

- External Validation: external entities and bank validation services.

- Business Details: business legal information, bank information, registration documents, etc.

- Contact Details: business and business owner contact details and copies of identification documents, etc.

- Risk Profile: business industry and category, policies, compliance certificates, etc.

- Risk Assessment: business processing history and projections, bankruptcy details and other.

- Linked Sub-Accounts: IDs and names of the linked Sub-Accounts, as well as their Platform Accounts’ names.

- Internal Notes & Documents: notes and documents added to the Underwriting Application.

- Processor Onboarding Details: data received from the processor; is only available for Underwriting Applications with Onboarding Completed, Ready To Process, Onboarding Failed, Sub-Account Creation In Progress, Sub-Account Creation Failed statuses.

- POS/Terminal Details: relevant information about created terminals; is only available for Underwriting Applications with Onboarding Completed, Ready To Process, Onboarding Failed, Sub-Account Creation In Progress, Sub-Account Creation Failed statuses.

- Pricing Details: pricing information; available for all Application statuses

Underwriting form can be embedded as an HTML document in an application custom component in external applications with branding according to Service Provider’s underwriting iFrame branding settings (colors, logos, header text etc.) and fields according to the relevant Underwriting Template settings.

Underwriting Applications Page Filters

Use filters to narrow down your search parameters.

Select Operator, Service Provider, Platform Account, and Sub-Account to display Underwriting Applications related thereto.

Use Date Range filter parameters to display Underwriting Applications for a specific date or a date range.

Sign-up Date – Application created

Approval/Decline Date – Last time the application set to approve or decline.

Resubmission Date – Last time the application was resubmitted.

Modification Date – Last time the application was modified.

Use Application Details filter parameters to find a particular Underwriting Application(s) based on its(their) Id, name, email, MID, status, or base template.

Use the Reset Filters button to clean all set parameters.

Use the Export button available for each report to export data in excel, csv, or json formats.

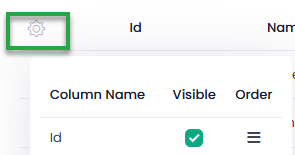

*Customize your report on Underwriting Applications through expand columns button.